Reversal from Highs: Negative Breadth Divergences Present

Although we recently reached new highs in most indices, many stocks and sectors did not.

Breadth Studies:

Short-term breadth studies have recently turned negative, indicating that the market is undergoing a pullback or consolidation phase. However, mid-term and long-term studies continue to show bullish conditions.

A negative breadth divergence has developed, as the recent new highs in the indices were not confirmed by ample breadth. In fact, many sectors and stocks did not make new highs recently. This lack of buying power is evident in the mid-term breadth studies chart. Although the green line is above the red line, indicating a bullish configuration, it is at a much lower level than the highs reached earlier this year. The green line is also getting dangerously close to flipping back to a negative condition, which will occur if the red line surpasses the green line. This would indicate that the market is back in correction mode.

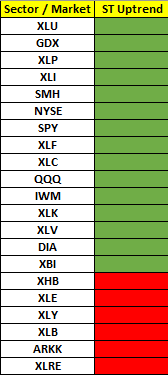

We can also observe this breadth deterioration by examining the short-term trends of the most important sectors.

Conclusion:

In my previous post, I stated: “For shorter-term oriented traders, there are some signs suggesting caution and a focus on profit-taking rather than initiating new positions or becoming aggressive at this point. It's prudent for traders to consider locking in profits, as the market may experience some consolidation or sideways action to cool off the recent bullish momentum.”

Technicals suggest we are currently going through that consolidation and cool-off phase after a powerful run higher during the recent earnings season.

We are in a bull market, and the benefit of the doubt favors the bulls. However, it is crucial to pay attention to the breadth divergences that are occurring. These divergences indicate that we may see a more modest and selective move higher in the coming months. If our mid-term breadth studies flip back to a correction signal, this time the pullback could be deeper and/or longer than the brief one experienced during April.

Additionally, even though we recently reached new highs, several key sectors, including homebuilders (XHB), energy (XLE), consumer discretionary (XLY), materials (XLB), real estate (XLRE), and the popular ARK Innovation ETF (ARKK), are all in a short-term downtrend and substantially off their previous highs. This lack of broad sector participation further supports the expectation of a period of consolidation or a more selective advance.

That is all for today.

Have a great weekend.

Best regards,

Victor Riesco, CMT