Oversold Signals Trigger in the S&P 500 & Nasdaq-100

Intense Selling Burst from the Recent Overbought Conditions

Quick update here:

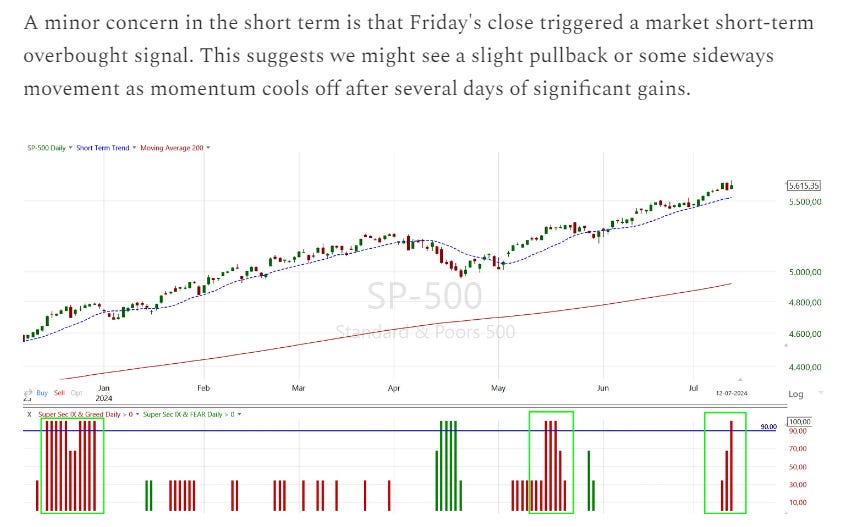

In my last update I stated the following:

From the recent overbought conditions, the slight pullback I was forecasting morphed into a fast sell off that clobbered the stock market.

Yesterday, the Nasdaq-100 & the S&P 500 both triggered short-term oversold signals. Despite selling off at the open, both indices are now reversing above their June high levels, indicating a potential false breakdown. Historically, when the Nasdaq-100 hits a short-term oversold condition, it tends to rally by 4% or more within the next 10 trading days about 90% of the time.

The brunt of the selling has occurred in mega-cap and semiconductor stocks. Despite this, market breadth has remained resilient, with signals not turning negative. The trend of new 52-week highs versus 52-week lows continues to be clearly bullish.

The VIX also spiked over 40% in the last 10 trading days. Historically, when this happens, the market tends to stabilize and often rebounds strongly in the following sessions.

Conclusion:

Quick sell-offs can be unsettling, often causing traders and investors to question the continuation of the bull market. However, the current situation may present a good buying opportunity. Long-term trends and breadth indicators remain positive, suggesting that the bull market is still intact.

It's important to monitor the recent lows from yesterday and today as key levels to manage risk. If the sell-off continues and breaches these levels, it could signal a more serious downturn.

Best regards,

Victor Riesco, CMT