New All Time Highs: Now What?

The S&P 500, Nasdaq-100 and Dow Jones Industrials Reached All Time Highs

In my previous post, I noted that the market correction was over and anticipated that the market would soon reach all-time highs. We have indeed achieved this milestone, with all major indices hitting record levels. Not only are equity indices at all-time highs, but gold, silver, and copper have also reached unprecedented levels.

We are currently in a bull market, with the primary trend being upward, so we should remain cautiously optimistic about the bulls' advantage. Now that we have reached all-time highs, what can we expect moving forward? I believe that in the longer term, the market will continue to rise.

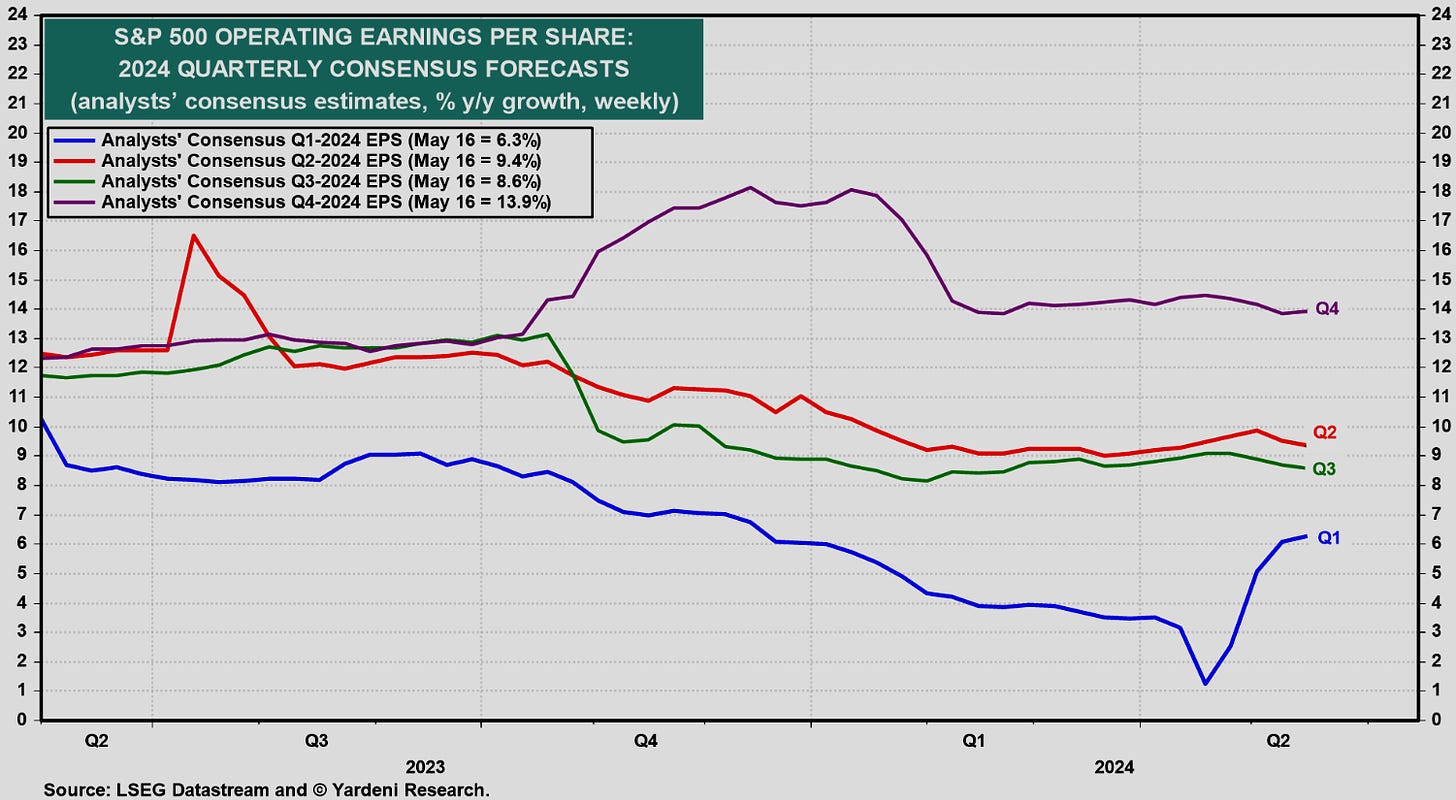

Our breadth and trend studies are bullish, and a significant fundamental component supports the market's advance: Earnings in the S&P 500 are growing faster than expected, with first-quarter earnings increasing by 6.3% compared to the anticipated 1.2%. This positive earnings surprise is prompting analysts to upgrade their forecasts, which in turn supports higher valuations.

Short Term Caution:

For shorter-term oriented traders, there are some signs suggesting caution and a focus on profit-taking rather than initiating new positions or becoming aggressive at this point. We have triggered a general short-term market overbought condition, and the S&P 500 Index itself is also indicating a short-term overbought signal.

Given these conditions, it's prudent for traders to consider locking in profits, as the market may experience some consolidation or sideways action to cool off the recent bullish momentum.

This doesn’t mean the market will drop sharply here (although it sometimes does), but it is more likely that we will see a period of chop, sideways drift, or a shallow pullback. This will allow the bullish momentum to reset and enable short-term moving averages to catch up with the price action. This, in turn, will likely present a good buying opportunity to capitalize on the long-term bullish trend.

That its all for today.

Best regards,

Victor Riesco, CMT

Thank you for the update, esp. the earnings situation is a good heads up!