Market Hits New Highs: Mid-Term Breadth Turns Bullish!

New highs have flipped the mid-term breadth signal back to bullish, although the signal remains at a very low level.

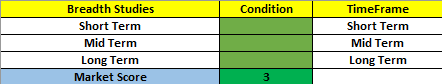

Breadth and Trend Studies:

With yesterday’s close, the mid-term breadth signal flips bullish. Bears had their shot but fumbled, failing to drive the market down. They caused some damage in April, but couldn't sustain the pressure for more than a couple of weeks. This time around, their selling barely left a mark.

We've reached new highs in the S&P 500 and the Nasdaq-100. However, the Dow Jones Industrials, Russell 2000, and NYSE Composite remain notably below their prior highs.

The trend in breadth has improved, with bulls dominating bears across all time frames. However, the bullish breadth level is very low and does not confirm the recent highs.

New High with Low Participation:

Jason Goepfert from Sentiment Trader shared a revealing chart on X yesterday after the close. His analysis illustrates how the market has historically behaved following similar breadth divergences at new highs, indicating that the market tends to perform poorly after such occurrences.

Jason tweeted: “The Nasdaq closed at a record high. But there were fewer stocks on that exchange rising to 52-week highs than falling to 52-week lows. This has not happened many times. The handful of times it did were...well.”

Gold and Silver:

Both are gaining traction and bullish momentum after a pullback from recent highs. The charts for both appear actionable, offering a promising risk/reward profile.

Conclusion:

The evident low breadth divergence is concerning, but the price action remains bullish. Additionally, the VIX fell sharply yesterday, returning to a downtrend, which is a positive sign.

In a bull market, we must give the bulls the benefit of the doubt and continue seeking bullish entries if our signals are positive.

Personally, given this situation, I am engaging on the long side with smaller positions and being very selective in my entries and the instruments I choose to trade.

That is all for today.

Best regards,

Victor Riesco, CMT