Choppy Market: Mid Term Breadth Signal Remains Bearish

Breadth & Trend Studies:

Market breadth has improved somewhat since our last update yet the most indices and stocks have chopped around during the last days. The sectors that had fallen the most during the previous week, bounced the most in recent sessions.

This caused our short term breadth study to flip back to POSITIVE but our mid term breadth signal remains NEGATIVE.

Primary trend signals overall remain bullish, but in the short term now the VIX is now in an uptrend which is a negative signal. The Russell 2000 via the IWM remains in a short term downtrend since last week.

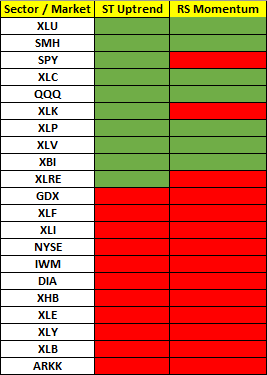

Looking at individual sectors, we have also seen a short term improvement.

I am reffering to real estate (XLRE), Biotech (XBI), Healthcare (XBI) and Consumer Staples (XLP)

The leading sectors like Semiconductors (SMH), Nasdaq-100 (QQQ), Communications (XLC) have remained strong and above its 21 day moving average albeit with some erratic action.

Bitcoin:

Bitcoin and the crypto market remains constructive and behaved well during the current choppy period in the equity market.

Bitcoin looks actionable here, with its short term uptrend & momentum in a bullish configuration, allowing an entry with a good risk profile.

Conclusion:

Despite the negative mid term breadth signal, the market has held well until now being the best case scenario I mentioned in the previous post, a choppy and erratic period.

We are still not yet out of the woods, so I warrant caution and being very selective until the mid term breadth signal flips back to bullish.

That is all for today.

Best regards,

Victor Riesco, CMT